In last decade, the Banking sector has been undergone drastic changes, reflecting a huge development in services. The impressive advancements in communication and information technology accelerated and broadened the expansion of financial information and services in the first place. As a matter of fact there is an imperative necessity to standardize the industry processes through interactive portals and location analytics. As both these sectors are location-based, by understanding the location of customers and their transactions, they can better manage the branch networks. It will also enable them to understand the competition and regulators. In this post we are going to focus on one of the key component of banking sector i.e GIS and Find out How useful is GIS in Banking Sector.

GIS in Banking Sector – Scope | Benefits | Uses

A customer-centric business model can help address the challenges in banking sector like ease of usability, skimming, web hacking and problems with customer services. Financial product and services and delivering them to customers are the major functions of banks. One of the required feature of Banking industries and financial services is Market analysis.

Banks and Financial services manages a ton of information data about their consumer, consumer’s profile and so much more, so database management for bank data and customer relationship management is one of the main functions of the banks and this can be easily achieved by the GIS. Using GIS in banking sector or Geographic modeling with future plans provides paramount benefits to the banking industry.

Benefits of GIS in Banking Sector :

- Expansion of Customer base and managing its database

- Improving Quality of the Services using GIS

- Increasing Consumer Satisfaction

- Consistent Business/ financial Growth and expansion

- Increase in Profitability

GIS can help in banking sectors various functional areas by providing support in decision-making and strategic planning of the Business and consumer. Effective resource management and operations management can possible by adopting GIS in banking sector.

How Useful and important is GIS in Banking Sector

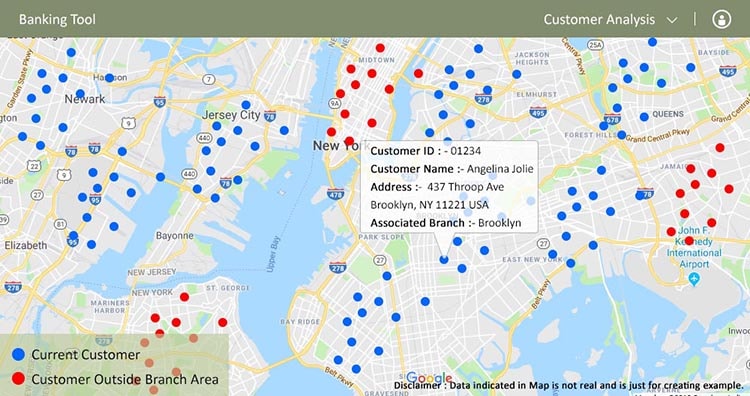

- Customer Analysis and Management: Customer analysis is useful in determination of customer characteristics like characterizing market segmentation of locations. It can help in convert a Postal address to a location reference such as to its corresponding position on the map. Catchment area for the branches can be drawn and areas which are not served can be easily identified. It helps displaying customers location on map in relation to a bank branch.

- Market Analysis : Defining the target group of audiences/customers for banks, we need GIS to develop the market segmentation. Marketing is a customer-orientated operation that is essential for business success of any bank. GIS based marketing analysis proves relevant and useful in understanding financial needs of market and potential customers for their finance products and services. GIS helps in pinpoint demand and supplies to their geographic locations. It also reveals the importance of geo-demographic research to marketing.

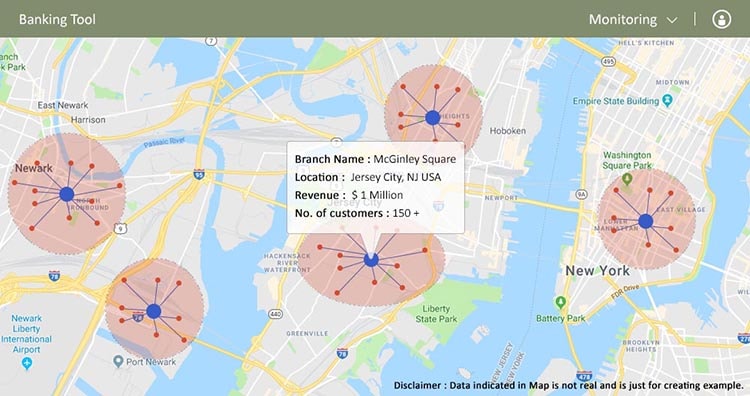

- Performance monitoring : Using GIS in banking sector, you can analyze and monitor performance of the branches using spatial components. GIS component of a branch review involves defining a trade area and identifying the nearby competitors. It can also help in drawing potential customers zones based on the spatial distribution of the customers.

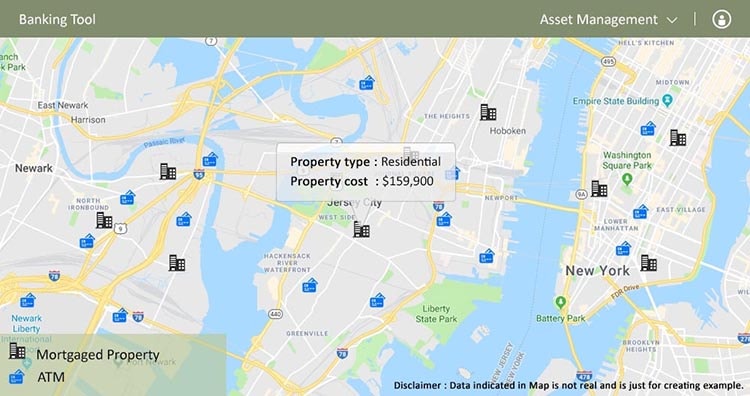

- Asset Management: Bank management needs to monitor a large amounts of information over an ever-changing inventory of physical assets. GIS helps us in managing Banks all the modern or traditional assets. This makes it possible to operate, maintain, and upgrade physical assets cost-effectively. Asset management includes management of mortgaged properties location and cost. As well as online tracking of cash status in ATMs and their distribution by using cash Van Fleet management. the spatial components puts requirements to maintain minimum asset condition.

Banking Sector manages all over world’s customer information, and the GIS in Banking sector database manages the data and customer relations of the bank. Geographic modeling with astonishing future plans provides crucial benefits to banking sector. GIS in banking can work as a strategic tool providing a competitive advantage. Geography based network analysis can be used for better business opportunities and will allow better understanding of market strength.

Do let us know how this Article is helpful for you, by commenting below in the comment box.

Hello Akshay,The information is very useful thnks for sharing can you tell me how to site this information? as i am thinking to use it in my rport

Thank you

Good, I like ,do you have a Textbook?

Thank you!